In our personal lives, we’ve undergone a transformation in our buying habits. Forbes predicts 20% of retail purchases will take place online in 2024, rising to 23% by 2027. Business-to-business (B2B) e-commerce predictably lags at only 14% of B2B purchases in 2023. However, for both B2B and business-to-consumer (B2C) purchases, the trend is clear: buyers are increasingly seeking online procurement routes, including cloud marketplaces.

One reason for this trend is that buyer preferences have shifted. As of 2022, 57% of B2B buyers were millennials, according to Forrester’s Buyers’ Journey Survey. Further, 32% of Gen Z consumers shop online at least once on a daily basis, compared to 25% of millennials. The buyer’s journey has also evolved. Younger B2B buyers are sourcing feedback from online forums like Reddit and heavily relying on product reviews to guide decision-making as they move down the funnel.

The untapped potential of the cloud

Cloud marketplaces, defined as digital marketplaces in which customers can purchase software and applications that run on the cloud, fulfill buyers’ desires for a digitally driven, frictionless experience.

Cloud is the future. Despite concerns around ballooning cloud cost and complexity, 73% of subject matter experts (SMEs) and global business leaders agree cloud migration achieves key business objectives. With over $300 billion in untapped cloud commitments across vendors, we believe cloud marketplaces are the path to reaching cloud-ready buyers and unlocking committed but unutilized IT budget.

The future of cloud marketplaces

The promise of cloud marketplaces remains aspirational. Yet, the vision of a frictionless, one-click experience achieved decades ago in the B2C space remains distant. Without dedicated marketplace resources and investment in automation, companies are unlikely to provide a great purchasing experience for customers.

The return on investment (ROI) of cloud marketplaces is compelling — 50% faster deal close, a 4-5x increase in deal size, and over 200% return on investment on average, according to Forrester. Creating a business plan for investment is key. The opportunity cost of not investing in scaling your cloud marketplace motion may also be significant. If competitors have a strong marketplace presence, they stand to gain from the 47% uncommitted cloud spend and over 80% 5-year compound annual growth rate (CAGR) of cloud marketplaces, while your market share may slowly erode.

Transition won’t happen overnight. Not every company needs to be a trailblazer; indeed, companies like CrowdStrike and Palo Alto Networks have already established themselves as leaders. However, independent software vendors (ISVs) who wish to remain relevant need a cloud marketplace strategy and roadmap inclusive of hyperscaler marketplaces that also considers distributors’ cloud marketplaces.

Spur Reply’s approach to building cloud marketplace success

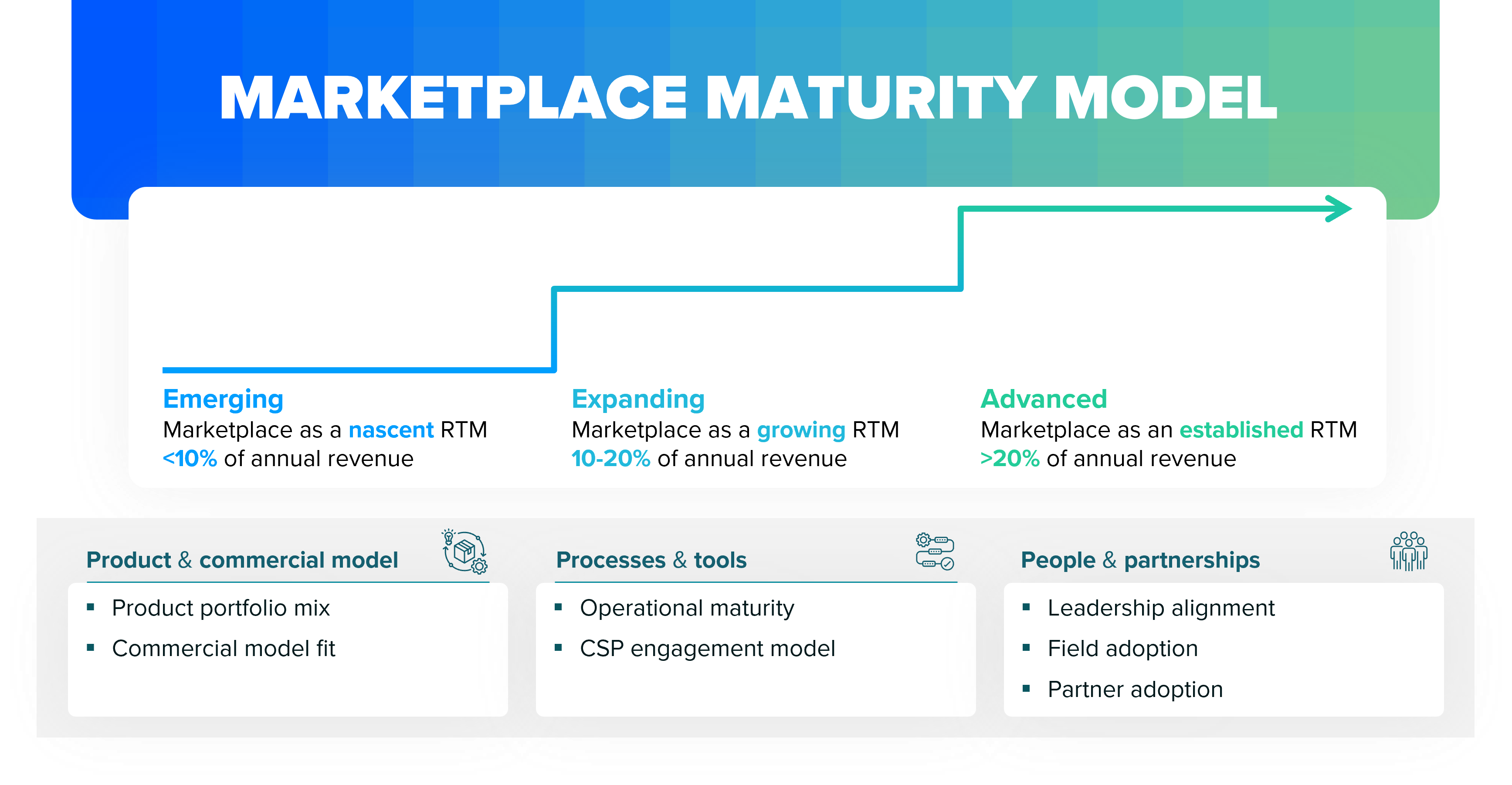

At Spur Reply, we use a holistic methodology to build cloud marketplace success. Our marketplace maturity model captures three essential dimensions of your approach: product, process, and people.

The first dimension to focus on is your products. You first need a defined marketplace strategy to guide your efforts and ensure executive buy-in from the outset. Without marketplace-ready products that have differentiated positioning and cloud-native commercial models, public offers will gain little traction and private offers will remain a challenge to transact via cloud marketplace.

The next dimension includes your processes. Growing operational maturity as well as an established cadence with cloud service providers (CSPs) is key; lack of automation and ad-hoc engagement with hyperscalers can impede growth.

Finally, the third dimension prioritizes your people. From start to finish, focus on providing your entire organization with the communication, tools, and resources they need to succeed. You should also aim to optimize how you work with partners to ensure cloud marketplace readiness can unlock business results.

Partners still matter

While cloud marketplaces initially served as a direct route-to-market, the top cloud marketplaces have built out partner-friendly motions. Partner listings drive significant traffic as well.

Partners continue to act as trusted guides through the digital transformation journey. Further, their value-add throughout the customer journey is not replaced by cloud marketplaces, which serve as a procurement route. Indeed, cloud marketplaces have the power to streamline multi-party collaboration on deals. They also serve as the key platform for co-sell with hyperscalers, strategic partners for any vendors with cloud-based solutions.

Curating a future-ready ecosystem of partners is more important than ever. An average enterprise B2B deal includes six products and services to deliver a single business outcome, according to Paul Bay, Ingram Micro’s CEO. Delivering targeted technology solutions that address customers’ business needs requires a rich mix of partner types advising customers, delivering software or hardware, wrapping around value-add services, and ensuring full value realization through adoption and optimization.

Build your cloud marketplace effectiveness

Innovation and collaboration will continue to be cornerstones of enterprise technology’s leading vendors. A wealth of growth opportunities exist that have yet to be unlocked with the power of the cloud. By building a marketplace plan tailored to your product, process, and people, and by expanding your partner ecosystem’s collective range of capabilities, you will have the keys to cultivate a highly successful cloud marketplace approach.

Want an assessment of your marketplace readiness and targeted recommendations on unlocking cloud marketplace for your company? Contact us today.